The Hidden Hero of M&A: How Modern MDM Unlocks Post-Merger Value

With modern master data management (MDM), enterprises can drive continuous value from M&A opportunities with context-rich data products that enable faster decisions and smoother integrations.

A study of over 40,000 corporate acquisitions found that ~70% of mergers fail to achieve the revenue and market-capture growth that were promised at the time of acquisition. Mergers and acquisitions (M&A) are often framed around strategic growth, market expansion, and operational synergies. But behind the scenes, there’s a less glamorous but critical challenge that can make or break the success of any integration: data.

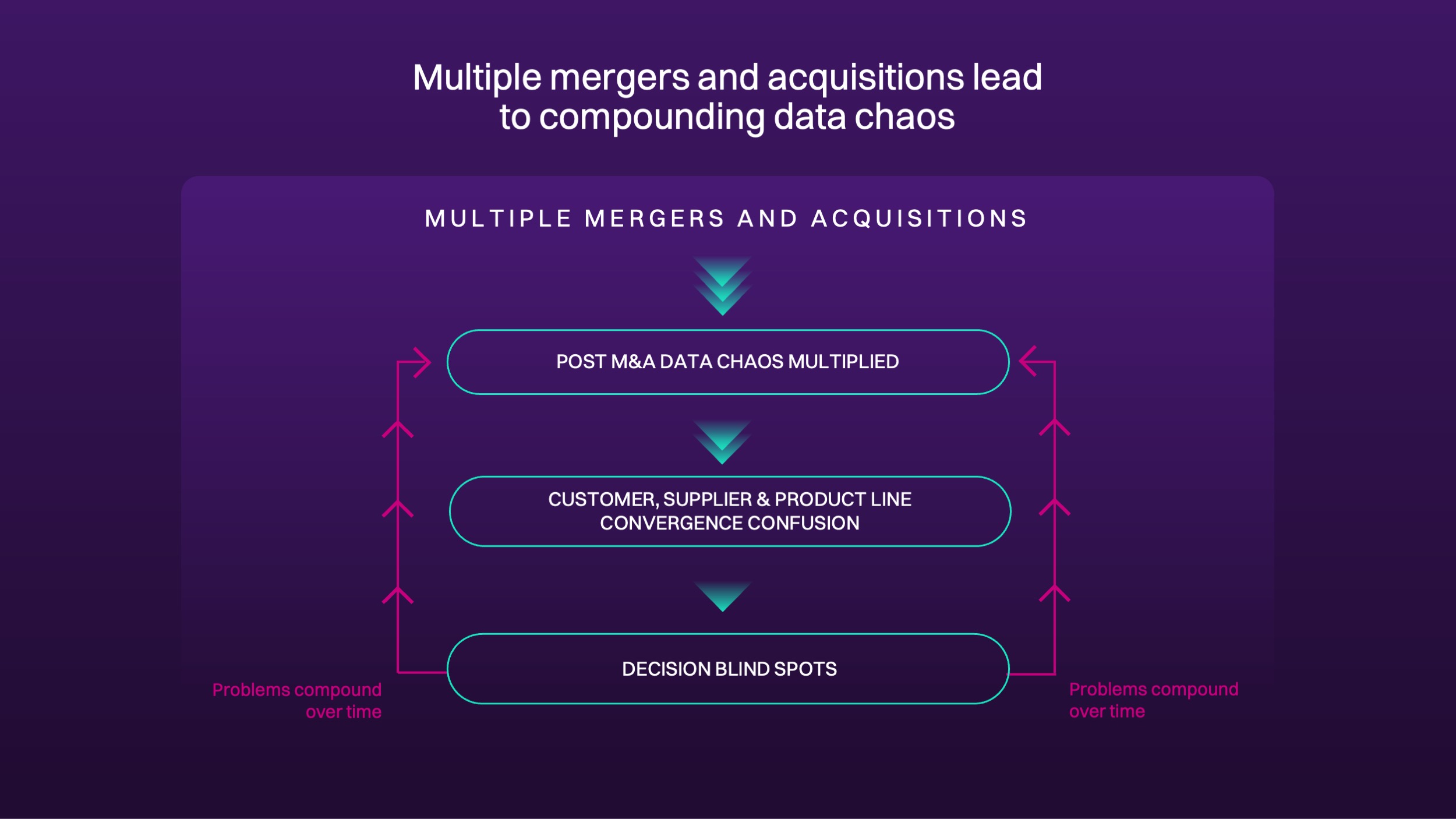

When two organizations merge, their data landscapes also connect. Bringing together data that was never designed to be joined becomes a complex and often daunting challenge. After multiple mergers, data problems multiply, leaving organizations with blind spots that hinder decision-making and ultimately impact business outcomes, stalling the synergies the mergers were meant to achieve.

That’s where modern master data management (MDM) steps in, not just as a technical necessity, but as a strategic enabler of post-merger value.

That’s where modern master data management (MDM) steps in, not just as a technical necessity, but as a strategic enabler of post-merger value.

The challenges of post-merger data migration

Merging data from two organizations is rarely straightforward. Common hurdles include:

Fragmented systems: Customer and supplier data live in siloed systems with inconsistent formats.

Duplicate and incomplete records: Multiple versions of the same entity exist with partial or conflicting details, often surfacing late and causing disruptive manual fixes.

Identifying shared customers and suppliers: Finding overlaps in customers and suppliers is critical for compliance and relationship management, as these often need to be treated differently compared to those that are newly acquired.

Siloed migration approach: Tackling migration on a source-by-source basis slows progress, compared to a targeted and holistic migration.

Flawed execution: Without visibility into migration readiness, data teams can lose control of the rollout and risk incomplete transitions.

These issues don’t just slow down integration; they compound over time and create blind spots that affect everything from customer service to compliance.

Where traditional MDM falls short

Post-merger, the ability to act fast matters. Whether it’s cross-selling to a newly expanded customer base, consolidating supplier contracts, or streamlining operations, none of it can happen without a clean, unified view of data, delivered fast and with high accuracy.

Traditional MDM systems struggle with this because they are:

Rigid and schema-dependent: Complex ETL processes don’t fit within the time-pressured M&A environment.

Poor at matching: Overwhelming manual intervention is often required, resulting in unlinked or duplicate transactions—or worse, false matches.

Limited by scale: Unable to handle today’s source data volumes and the required frequency of rebuilds to accommodate additional data sources.

Costly to integrate: Delivering direct value to business use cases requires expensive custom integrations to operational or analytical environments.

Modern MDM: A strategic enabler of value

This is where Quantexa steps in. Not just as a technical solution, but as a strategic enabler of post-merger value.

Quantexa’s Data Modernization capabilities are built to tackle the complexity of post-merger integration. Here’s how we help:

World-class data matching at scale: Our category-leading entity resolution technology matches billions of data records with high accuracy to connect fragmented data points —names, addresses, transactions, and more—into a single, trusted view of real-world entities.

High-quality data products: By unifying internal and third-party data, Quantexa enables high-quality, reusable data products that fuel migration planning, analytics, sales, marketing, and compliance efforts.

Built-in data quality: Quantexa’s integrated data quality rules assess and score customer profiles to flag exceptions for review and enable proactive remediation before migration begins.

Migration state management: Quantexa supports alerting to act on migration-ready customer profiles and reconcile legacy and target state customer profiles via a feedback loop.

Intuitive data quality visualization: Quantexa enables data teams to track migration readiness and accelerate time to value through visual dashboards to prioritize efforts and act faster.

Continuous intelligence: Data products become the foundation for ongoing customer intelligence, operational efficiency, AI adoption, and growth to drive long-term and continuous value.

Alongside supporting data modernization initiatives, Quantexa's contextual analytics and decision intelligence drive direct post-merger value creation across integrated businesses via cross-sell/upsell, winback campaigns, risk exposure management, and supplier cost optimization.

The impact of context in action with Vodafone

Over three decades of mergers and acquisitions, Vodafone Business had built a rich and diverse data landscape, but it became increasingly complex and harder to manage. Working with Quantexa, Vodafone created a single customer view by unifying its internal and external data to unlock deeper insights that drive greater efficiency and measurable business impact. In March 2025, Vodafone took a major step forward with the implementation of modern MDM. This initiative focused on creating clean, governed, AI-ready data across the enterprise.

Read the full customer story here.

M&A is about more than combining balance sheets—it’s about combining potential. But synergies can only be realized if the data is right. With Quantexa, businesses can move beyond the chaos of post-merger data and into a future where every decision is backed by clarity, confidence, and context.