A Guide to Creating Personalized Digital Services in Insurance

Learn how to leverage the power of AI and Advanced Analytics to manage changing customer expectations – and thrive in the digital age.

Stimulez la croissance des primes, réduisez le taux de désabonnement et diminuez les taux de pertes grâce à la prise de décision basée sur l'IA. les taux de sinistres grâce à la prise de décision basée sur l'IA. Transformer les informations des données connectées en actions à travers la chaîne de valeur de l'assurance.

Fournissez une vue contextuelle à 360° de chaque partie et de chaque risque, en vous aidant à découvrir des liens comportementaux cachés qui accélèrent la modernisation des données.

Transformez vos informations en actions qui vous permettront de découvrir des opportunités de distribution, d'automatiser la souscription et l'évaluation des sinistres et d'approfondir les relations avec vos clients.

Favoriser une croissance rentable en améliorant jusqu'à 50 % la conversion des devis en commandes, tout en réduisant les ratios de pertes et de frais jusqu'à 3 %.

Automatiser la prise de décision en matière de segmentation des risques afin d'arrêter les fuites, de prévenir la fraude et de réaliser des économies sur les indemnités, améliorant ainsi les taux de sinistres de 1 à 3 %.

Améliorez la précision de la densité des comptes jusqu'à 60 % et l'efficacité des ventes jusqu'à 90 %, tout en améliorant la fidélisation et en réduisant le taux de désabonnement en identifiant plus tôt les clients à risque.

Offrez des déclarations de sinistre directes et fiables et une souscription sans contact grâce à une vision holistique de la segmentation des clients, de la propension au risque, de la fraude et des recouvrements.

Pilotage/surveillance proactive à 360 degrés du portefeuille pour prévenir la fraude, réduire l'exposition ESG et renforcer les défenses automatisées en matière de KYC, de sanctions et de chaîne d'approvisionnement.

Construisez une vue à 360 degrés du client et du producteur pour identifier de nouveaux marchés à pénétrer, découvrir plus rapidement des opportunités de cross-sell et distribuer plus intelligemment dans des environnements omni-canaux.

Unifier les informations historiques sur les soumissions pour les évaluer plus rapidement en fonction de l'appétit pour le risque et pré-souscrire de nouveaux clients avec moins de frictions pour maximiser la capacité d'accueil.

Rationaliser les déclarations de sinistre grâce à une vue connectée à 360° des parties, en améliorant la segmentation des sinistres et l'expérience client tout en réduisant les fuites, les litiges et les risques de subrogation.

Fournir une vision holistique du portefeuille afin d'augmenter la rapidité et la précision de la souscription perpétuelle et d'améliorer l'évaluation des risques du portefeuille dans toutes les lignes d'activité.

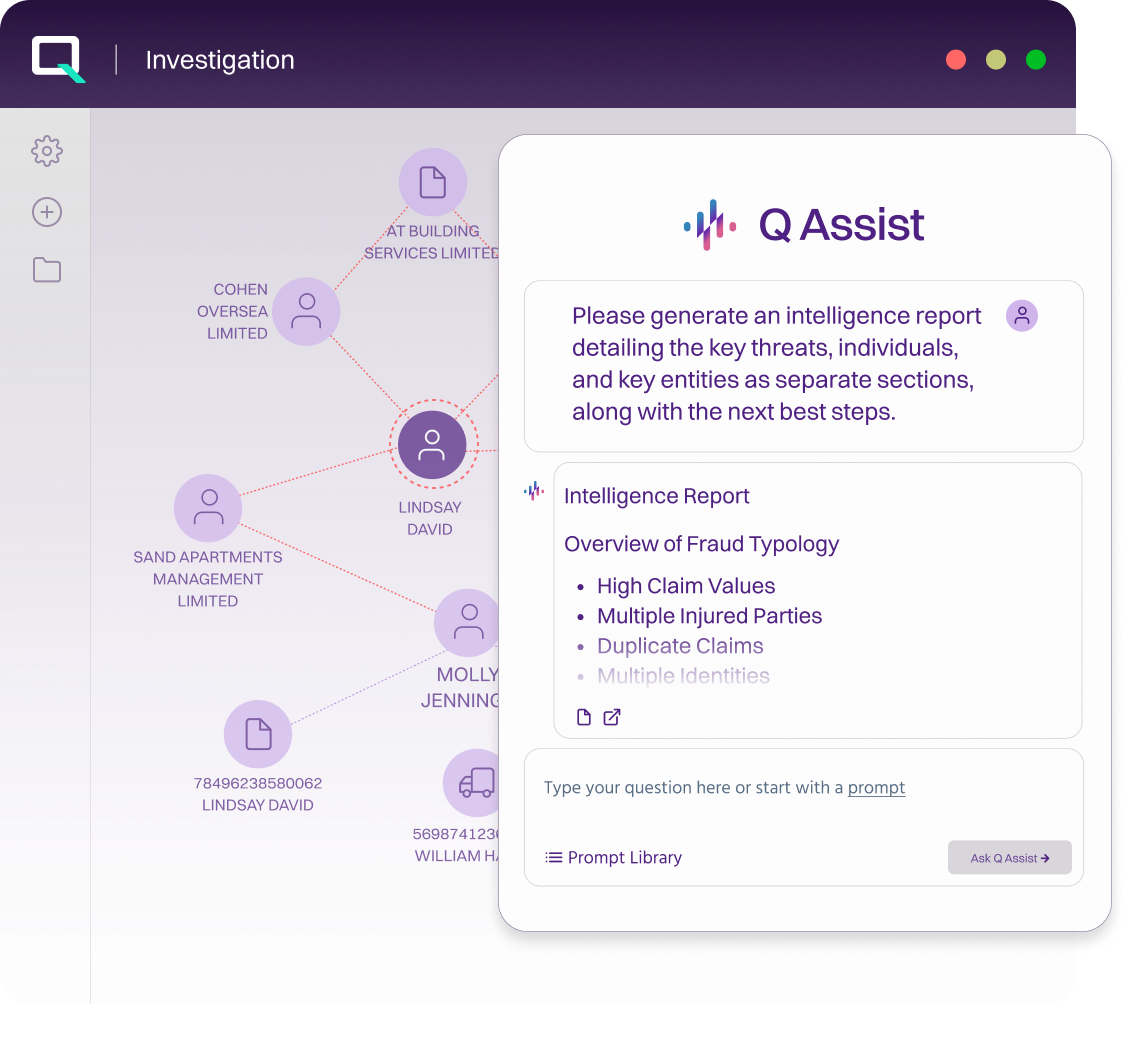

Améliorez la sophistication de vos défenses contre les menaces grâce à une vision unifiée des risques, à une détection contextuelle améliorée des fraudes et à des solutions d'enquête robustes sur la criminalité financière.

Conçue spécialement pour l'assurance, notre plateforme s'intègre aux flux de travail existants et offre un time-to-value plus rapide dans l'ensemble de l'organisation.

amélioration du taux de sinistres

du travail de souscription automatisé avant la réception de la demande.

d'augmentation des revenus de cross-sell par an.

amélioration de la précision de la vue unifiée du client, du courtier et du canal.

réduction des faux positifs, amélioration des scores STP et NPS.

Comment le paysage complexe de l'assurance et les données de mauvaise qualité affectent la croissance.

Les nouvelles opportunités et les stratégies de croissance éprouvées

Les façons dont les données contextuelles, l'analyse et l'IA accélèrent la croissance rentable et améliorent les expériences des clients.

Un cadre pour la réussite de l'intelligence décisionnelle afin d'obtenir des résultats mesurables

Créer une vue unifiée et automatisée de chaque assuré, de chaque demande et de chaque première partie pour tous les produits, toutes les marques et toutes les régions. Identifiez les risques de désabonnement, proposez des offres de cross-sell personnalisées et optimisez l'expérience client à chaque étape du cycle de vie.

Éliminez les silos de données et créez une vue fiable et connectée des sources internes et externes. Résolvez les données incomplètes ou de mauvaise qualité en temps réel pour révéler des relations et des hiérarchies exactes - en alimentant de multiples cas d'usage dans toute l'entreprise.

Protégez votre entreprise grâce à une vision holistique à 360° du risque de fraude au niveau de la souscription, de la gestion des polices, des déclarations de sinistre et des chaînes d'approvisionnement. Détectez deux fois plus d'activités suspectes avec 70 % de faux positifs en moins - en veillant à ce que les clients authentiques soient traités équitablement.

50%Amélioration de la cotation et de la conversion

70%Amélioration de l'impact de la fraude

30xAccélération de l'établissement du profil des clients et de l'évaluation des risques dans le cadre de la souscription

80%Réduction du nombre de cas complexes

En s'associant à Quantexa, Zurich intègre le meilleur des capacités numériques et humaines pour obtenir des résultats positifs pour les clients en automatisant et en améliorant le processus de déclaration de sinistre.

HEURES ÉCONOMISÉES GRÂCE À L'AUTOMATISATION DES TÂCHES MANUELLES

Oui, et vous devriez le faire. Les CRM sont parfaits pour l'engagement, mais ils n'ont pas été conçus pour la prise de décision en matière d'assurance. Quantexa ajoute la couche d'intelligence qui transforme votre CRM en un moteur de croissance pour la souscription et la distribution.

Définitivement. L'accès n'est pas le problème. C'est la fragmentation qui l'est. Nous unifions vos données en utilisant la résolution d'entités en temps réel et l'analyse de graphes pour vous donner une vue connectée et contextuelle de votre entreprise.

Vous commencez avec une base unifiée. Notre cadre décisionnel s'adapte aux différents produits et juridictions, tout en conservant une logique cohérente et vérifiable. Des décisions intelligentes, partout.

Vous automatisez les informations. Quantexa révèle les opportunités d'espace blanc et de densité de produits à l'aide de l'analyse de graphes - pas de feuilles de calcul, pas de conjectures, juste une croissance ciblée et opportune.

L'intelligence se superpose à l'intelligence. Nous nous connectons à vos systèmes existants et accélérons le triage, la sélection des risques et la prise de décision grâce à l'IA - pas de perturbation, juste de meilleurs résultats.

Faites en sorte que chaque prise de décision compte. Avec Quantexa, vous verrez les chiffres bouger : un temps de devis plus rapide, une densité de produits plus élevée, de meilleurs ratios de pertes et une meilleure performance des canaux de distribution.

Quantexa relie des données cloisonnées pour créer une vue contextuelle à 360° des clients, des ménages et des entreprises. Cela permet aux assurances d'identifier les opportunités de cross-sell et d'upsell, de personnaliser les offres et d'améliorer la fidélisation des clients.

En mettant au jour des relations et des réseaux cachés, Quantexa améliore l'évaluation des risques au-delà des données traditionnelles. Cela permet un scoring dynamique des risques, une tarification compétitive pour les clients à faible risque et une réduction de l'exposition aux entités à haut risque.

Quantexa utilise l'IA et l'analyse des graphes pour détecter les schémas de fraude cachés, évaluer les déclarations de sinistre dans leur contexte et réduire les fuites grâce à la détection automatisée des anomalies. Cela renforce les contrôles tout en accélérant les déclarations de sinistre authentiques.

Quantexa unifie les données à travers la souscription, les déclarations de sinistre et la distribution, créant ainsi une source unique de vérité. Combiné à l'automatisation pilotée par l'IA, cela réduit les efforts manuels et améliore l'efficacité dans l'ensemble de l'entreprise.