Know Your Customer

Transform your KYC processes with an advanced, data-led approach that drives confident decision-making. Position yourself for perpetual monitoring and dynamic assessments of customer risk.

Request a demoGain more insight into your customers

Built on the Decision Intelligence Platform, Quantexa maximizes all connected data to create a single view of customers that facilitates a proactive approach to reviewing behaviors, identifying risk and opportunities and ultimately powering confident, continuous decision-making.

90%

Reduction In time taken to build complex legal hierarchies

85%

Noise reduction in trigger volume

HOW WE SOLVE IT

Use context to understand your customers better

Create a single customer view

Combine billions of internal and external data points and enrich them with intelligence to create a single view of customers and their relationships.

Uncover relationships in real time

Quickly and seamlessly identify connections across all available data sources to unwrap customer ownership, hierarchies, and control structures – and more.

Highlight new or changing risk levels

Reduce the need for due diligence with continuous and dynamic monitoring to highlight hidden, new or changing risk, with real-time recalculation of risk scores.

Auto-populate and power administration

Automate data gathering and analysis and minimize customer outreach efforts.

Expand your journey to perpetual KYC

Take an incremental approach to transforming KYC processes and maximize the value of each phase of risk monitoring.

Automate and optimize

Automatically apply bank policy risk logic to drive actions such as straight through processing of immaterial low risk changes or material high-risk reviews.

THE IMPACT

What we have achieved

KYC ops cost reduction

of KYC fields automatically populated

in name screening

trigger event reduction

Quantexa KYC benefits

Transform KYC processes With Quantexa

Get an overview of Quantexa’s Know Your Customer solutions

category-leading technology

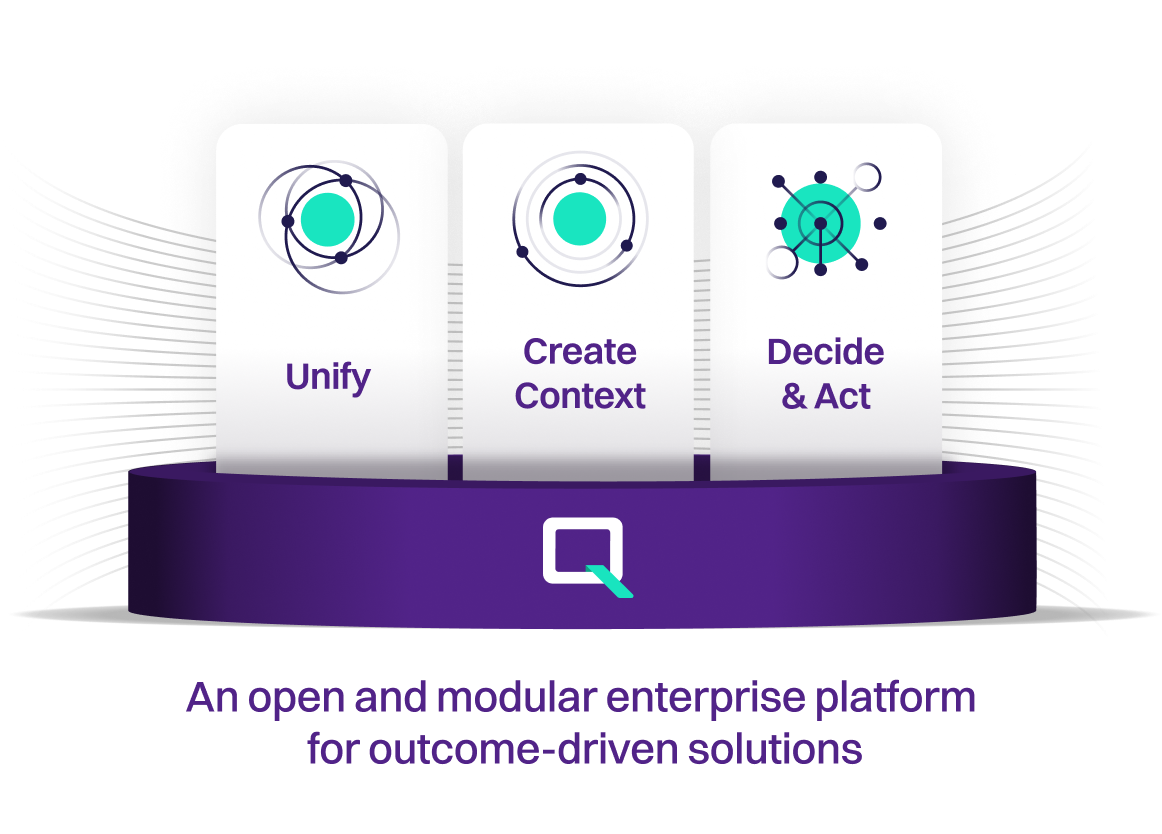

Our Decision Intelligence Platform

Build a single view of data and create a culture of confidence around critical decision-making that protects, optimizes, and grows your organization.

Generative AI

Human/AI decisioning for Know Your Customer

Leverage Q Assist to streamline KYC processes and make decisions about your customers faster and more effectively.

Decision Intelligence solutions built on our platform

Data Management

Build a trusted data foundation to deliver context for decision-making.

Learn moreCustomer Intelligence

Enhance customer experience and accelerate revenue growth with a 360-degree connected view of customers.

Learn moreRisk Management

Revolutionize risk assessment with a holistic understanding of borrowers, their counterparties and relationships.

Learn moreFraud and Security

Uncover hidden fraud risks with a contextual approach to detection and prevention.

Learn moreFinancial Crime

Take a unified approach to fighting financial crime and fraud with our Contextual Monitoring solutions.

Learn moreAML and Investigations

Reduce false positives and focus on real risk by modernizing your AML monitoring, detection, and investigations.

Learn moreFAQs

What differentiates your KYC solution from the rest?

Through advanced Entity Resolution and Graph Generation, Quantexa's KYC software can automate the use of internal and external data sources to monitor for changes against current KYC profiles, including ownership structure. This provides enriched context and changes the way customer information can be used to automatically detect risk and opportunities.

These advanced capabilities drive the automatic recalculation of profiles by identifying new direct and indirect material risk, reducing unidentified risk and reputational consequences, and narrowing the focus to significant, relevant risk to investigate further.

Our collective, enhanced capabilities enable a more dynamic, comprehensive understanding of a customer, which drives a unique, proactive and dynamic approach to KYC decision-making.

We currently have a timed and manageable KYC process that we feel works. How can your KYC solution add further value and not be disruptive?

We are not trying to replace the work your operations teams are currently undertaking but will enhance it with automation and intelligence. With our Entity Resolution and Graph Generation, we can build a more complete picture of material risk for targeted reviews and enrich your existing approach with the detection of risks linked to the customer behavior and related counterparties. This enriched view can integrate into existing models to drive better risk detection and automate ownership structure-building.

The comprehensive journey to pKYC can be incremental and focused on significant challenges to start. Many of our customers take a phased approach based on priorities such as increased risk monitoring or improved efficiency. Along this journey, you will more clearly identify material risk that will help to manage the overall KYC process more effectively.

Also, through seamless, open architecture, your teams can continue to use the tools they are using today (e.g, CLM, Risk model, Python, R) with limited interference.

Is Perpetual KYC (or pKYC) as Quantexa defines it, truly realistic?

Yes. Leading companies are either on a calculated journey to pKYC with us or are already there. Leveraging our Decision Intelligence (DI) Platform which is underpinned by world-class Entity Resolution and Graph Generation, enables us to lay the trusted data Foundation and drive a transformative approach to KYC. By connecting all available internal and external data and assessing behavior, we create a unique, holistic view of customers to detect risk and opportunities automatically and continuously. We simplify the analysis of complex relationships and corporate hierarchies by overlaying risk attributes to seamlessly uncover hidden connections between customers, counterparties and their behaviors, which are often impossible to see in isolation. This dynamic approach helps transition from 1,3,5-year reviews to a dynamic trigger-based KYC process that improves inefficiencies and facilitates a continuous, informed, realistic understanding and accurate review of these risks through perpetual monitoring.

What is Quantexa’s definition of Perpetual KYC (pKYC)

Perpetual KYC (pKYC) is the continuous process of customer monitoring that is executed through a trigger-based approach to KYC refresh. This allows financial institutions to transform from the static periodic refresh model of 1,3,5-year reviews to a continuous dynamic model. pKYC is a context-driven approach that enables real-time accurate reviews, up-to-date client risk rating, improves efficiencies, reduces customer friction, mitigates the rising cost of compliance and enables your organization to meet continuously changing regulations.

Where can I meet other KYC professionals using Quantexa?

Our Specialist User Groups are where customers, partners, Quantexa experts and thought leaders can share expertise, experience and knowledge across the globe on the use of data, technology & analytics.

The KYC - Know Your Customer User Group focuses on unlocking the potential in your data, operations and network to move away from the heavy processes and enable a shift back to the core purpose of KYC in understanding the risk associated with prospects, customers and their related activity across the life cycle.

Latest from Quantexa

DRIVE INDUSTRY TRANSFORMATION

Speak to an expert

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.