Know Your Customer

Get a contextual single client view. Develop a more precise understanding of every customer and their risk. Enable perpetual monitoring.

Gain more insight into your customers

An airtight KYC process requires a complete view of every customer - which is impossible to achieve without a single view of your data. Strengthen the foundations of KYC with continuous monitoring to enable real-time insight into evolving customer risk.

HOW WE SOLVE IT

Use context to understand your customers better

Create a single customer view

Combine billions of internal and external data points and enrich them with intelligence to create a single view of customers and their relationships.

Uncover relationships in real time

Quickly and seamlessly identify connections across all available data sources to unwrap customer ownership, hierarchies, and control structures – and more.

Highlight new or changing risk levels

Reduce the need for due diligence with continuous and dynamic monitoring to highlight hidden, new or changing risk, with real-time recalculation of risk scores.

Expand your journey to perpetual KYC

Use an incremental approach to transforming your KYC processes to maximize the value of each phase of risk monitoring.

THE IMPACT

What we have achieved

between customers and external data

of KYC fields automatically populated

in name screening

Transform your KYC processes across the customer lifecycle

WHERE WE HELP

Transform KYC processes With Quantexa

Onboarding

Automate and simplify manual onboarding processes to reduce customer friction and improve compliance.

Remediation

Simplify manual KYC processes with large volumes of profiles, reduce costs, and meet changing regulations.

Enhanced Due Diligence

Bring consistency to high-risk customers reviews and make better, faster risk decisions.

Perpetual KYC (pKYC)

Transform your current reactive and static KYC process into a proactive and dynamic approach.

Get an overview of Quantexa’s Know Your Customer solutions

category-leading technology

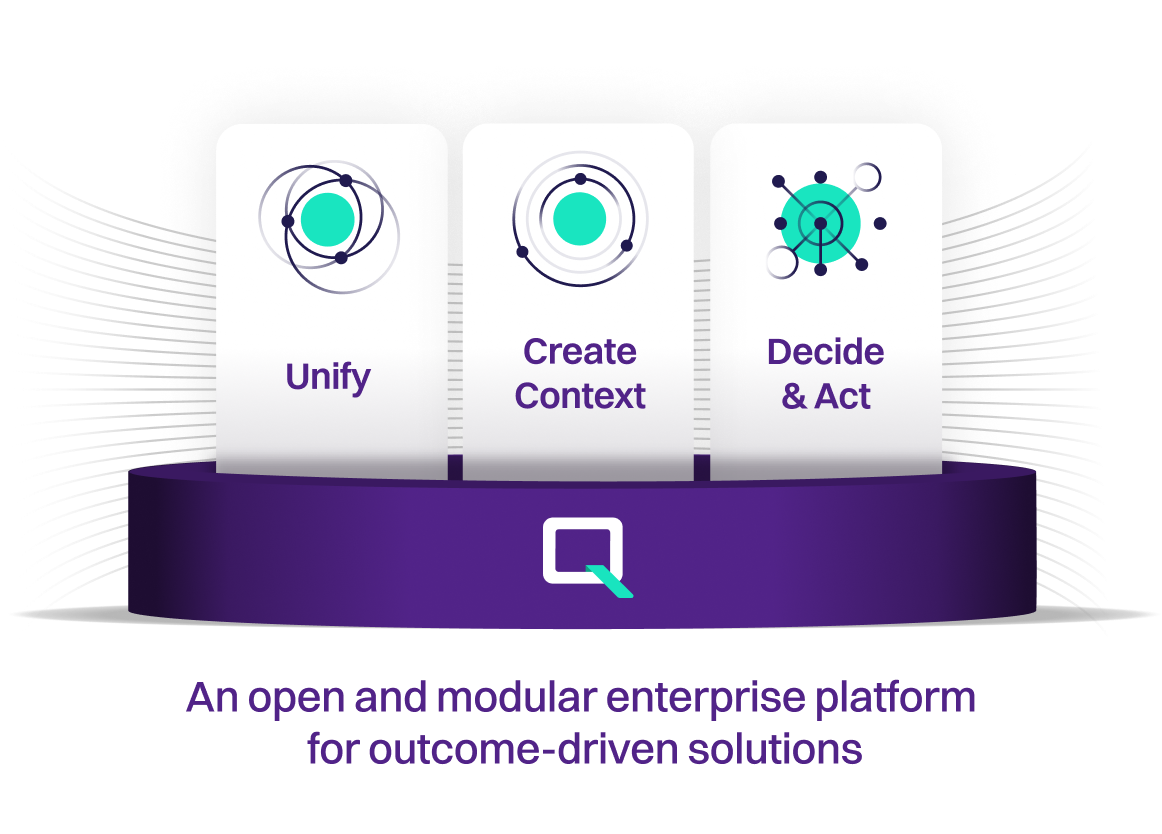

Our Decision Intelligence Platform

Build a single view of data and create a culture of confidence around critical decision-making that protects, optimizes, and grows your organization.

Decision Intelligence solutions built on our platform

Data Management

Build a trusted data foundation to deliver context for decision-making.

Learn moreCustomer Intelligence

Enhance customer experience and accelerate revenue growth with a 360-degree connected view of customers.

Learn moreRisk Management

Revolutionize risk assessment with a holistic understanding of borrowers, their counterparties and relationships.

Learn moreFraud and Security

Uncover hidden fraud risks with a contextual approach to detection and prevention.

Learn moreFinancial Crime

Take a unified approach to fighting financial crime and fraud with our Contextual Monitoring solutions.

Learn moreAML and Investigations

Reduce false positives and focus on real risk by modernizing your AML monitoring, detection, and investigations.

Learn moreFAQs

Latest from Quantexa

DRIVE INDUSTRY TRANSFORMATION

Speak to an expert

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.