Fraud and Security

Build a risk-based model that alerts to complex fraud typologies. Uncover previously hidden risk. Accelerate fraud investigations.

Request a demoCreate context to counter the rise of fraud

Fraud losses are rising, and countless cases go undetected and underreported. Counter-fraud teams need a holistic, context-based understanding of all relevant entities, networks, and behaviors to improve fraud prevention success. Quantexa provides a highly-targeted approach to fraud to help you understand the risk-relevant relationships between entities.

HOW WE SOLVE IT

Amplify the impact of counter-fraud operations with context

Connect disparate datasets

Form 360-degree views of entities that are 99% accurate by aligning billions of data points from internal and external sources.

Reduce false positives

Focus valuable resources on the threats that matter most with dynamic views of entities, high-quality alerts, and deeper insights.

Address “harder” typologies

Quantexa helps investigation teams tackle typologies that can’t be solved by simple rulesets applied to single datasets in isolation.

Interlink distinct entities

Understand entities’ complex relationships and behaviors, including hidden and subtle activities, to gain a broader picture of fraud risk.

Create a controllable analytics environment

Quantexa’s fully flexible, contextual analytics framework plugs into any machine learning library and rules detection and case management workflow.

Increase self-sufficiency

Own and manage the scenarios, models, and scorecards created with Quantexa while continuing to benefit from our established detection routines.

THE IMPACT

What we have achieved

$3Bthe amount of fraud Quantexa has helped organizations detect

in investigation time (at scale)

in false positives

in fraud savings

We help detect and investigate hidden fraud risk faster

Explore our Fraud and Security solutions

For Banking

Complex Fraud Investigations

Perform complex investigations across all data to identify new and unidentified risks.

Scams and Mule Network Detection

Detect fraud victims faster and speed identification of suspicious accounts and networks.

Lending Fraud Detection

Reduce losses across the full customer lifecycle and all customer types.

Internal Fraud Detection

Detect insiders engaged in defrauding the bank or the institution’s customers.

Supply Chain Integrity

Identify activities signaling supplier integrity risks and pinpoint employees and third parties engaging in them.

For Insurance

Application and Underwriting Fraud

Identify fraud across the full customer lifecycle and all distribution channels.

Claims, Billings, and Provider Fraud

Block fraudulent payments and stop claims leakage across the claim, billing and payment lifecycle.

Internal Fraud Detection

Detect insiders engaged in defrauding the insurance organization or the firm’s customers.

Supply Chain Integrity

Identify activities signaling supplier integrity risks and pinpoint employees and third parties engaging in them.

Complex Investigations

Perform complex investigations across all data to identify new and unknown risks.

For Government

Tax Fraud and Evasion

Use real-time advanced capabilities to integrate internal and external data for a consolidated view of tax evasion risk.

Customs, Goods, and Duties

Gain a single view of risk to facilitate efficient investigations and the safe and effective movement of goods in real time.

Supply Chain Integrity

Identify activities signaling supplier integrity risks and pinpoint employees and third parties engaging in them.

Grants, Benefits, and Other Payments

Detect and deter criminal deception or mismanagement with intuitive analysis, investigations, and proactive decisioning.

Borders and People Movement

Enable the safe and efficient movement of people in real time with a single view of risk.

Complex Fraud Investigations

Perform complex investigations across all data to identify new and unidentified risks.

Scams and Mule Network Detection

Detect fraud victims faster and speed identification of suspicious accounts and networks.

Lending Fraud Detection

Reduce losses across the full customer lifecycle and all customer types.

Internal Fraud Detection

Detect insiders engaged in defrauding the bank or the institution’s customers.

Supply Chain Integrity

Identify activities signaling supplier integrity risks and pinpoint employees and third parties engaging in them.

Get an overview of Quantexa’s Fraud and Security solutions

category-leading technology

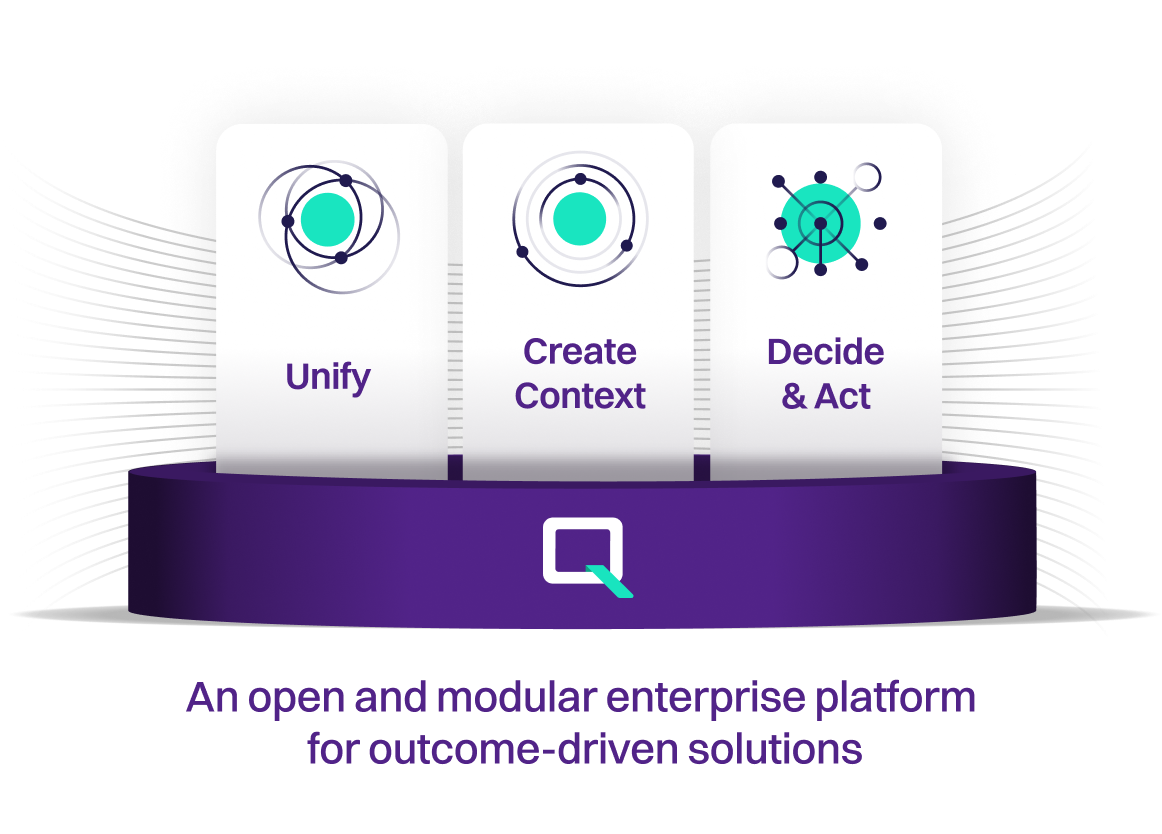

Our Decision Intelligence Platform

Build a single view of data and create a culture of confidence around critical decision-making that protects, optimizes, and grows your organization.

Generative AI

Human/AI decisioning for Fraud

Leverage Q Assist to empower your Fraud teams with speed and intelligence to accelerate investigations and prevent fraud effectively.

Decision Intelligence solutions built on our platform

Data Management

Build a trusted data foundation to deliver context for decision-making.

Learn moreCustomer Intelligence

Enhance customer experience and accelerate revenue growth with a 360-degree connected view of customers.

Learn moreKnow Your Customer

Detect risk in real time to identify unknown risks and deliver more accurate risk ratings.

Learn moreRisk Management

Revolutionize risk assessment with a holistic understanding of borrowers, their counterparties and relationships.

Learn moreFinancial Crime

Take a unified approach to fighting financial crime and fraud with our Contextual Monitoring solutions.

Learn moreAML and Investigations

Reduce false positives and focus on real risk by modernizing your AML monitoring, detection, and investigation.

Learn moreFAQs

Do you provide real-time capabilities to prevent fraud?

A new contextual approach is required to improve fraud prevention, detection, and investigation. Market participants have raised challenges with using real-time capabilities which are missing risk and blocking legitimate payments or adding friction, which is impacting the customer experience.

However, Quantexa can detect suspicious transactions in near-real-time and alert to ensure high-risk transactions can get immediate attention. Quantexa can also augment with existing technology to provide additional context to illuminate high-risk transactions or provide confidence through mitigating factors that the transaction is legitimate and non-fraudulent.

What out-of-the-box models do you have?

Detection Packs for fraud deliver higher true positives, lower false positives. For additional coverage, we have knowledge and IP, but we will work with your teams to develop using your own data.

I already have a single customer view which we use for fraud. What will Quantexa provide in addition?

Even where our clients already have a system in place to provide a single view, we have still provided deduplication rates of up to 20%.

Our ability to ingest internal and external sources means we have greater breadth and flexibility in the view.

Our ability to perform automated network (entity-powered graphs) enables you to go beyond the customer view to look at relationships, associations, and hidden connections.

Our dynamic Entity Resolution enables tailored views for different fraud and value-chain needs so that you aren't constrained to a one-size-fits-all - solution, which is both useful operationally but also from a security control perspective.

Our analytics and visualization platform enables transparent models to be built in conjunction with your teams and improved operational efficiency in complex triage, etc.

Our analytics team is already doing this work (e.g., bust out fraud). Why do we need Quantexa?

We are not trying to replace the work your client analytics teams are doing, but to enhance it. We can provide a richer 360 view with networks that they can use as inputs to their models to drive better performance. We have an open architecture which means they can continue to use the tools they are using today (eg., Python, R, TensorFlow).

I don’t want another fraud interface. Can this integrate into my existing interface for my fraud uses?

The output of Quantexa can be integrated within existing systems – including other fraud solutions or in-house-developed tools. Quantexa can send signals to other tools which can then give users the options to use Quantexa to perform the investigation or look at the network in more detail.

The network UI is too confusing for business users. Can it be simplified?

The network UI does not need to be presented to business users – a simplified view with only the pertinent information can be integrated within existing systems. Quantexa can cater for all levels of investigator within the fraud team to support them in their role and to determine the best course of action.

In addition, Quantexa has a training academy to enable users to get the most from the tool and learn new ways to help them investigate and achieve better outcomes.

Latest from Quantexa

DRIVE INDUSTRY TRANSFORMATION

Speak to an expert

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.