How Chief Information Officers are Transforming Banking’s Future

Find out how HSBC’s Global Data CIO is using data and technology to open new roads to profitability by reimagining how banks can better serve their customers.

Loading

LoadingOrganizational leaders have discovered the Quantexa difference.

Quantexa has enabled us to work with our customers in areas like supply chain resilience. [HSBC] now has the data to understand where our customers may face threats, but also where there are opportunities in supply chains to streamline [our process and] build resilience and transparency.

Challenge

Challenge Solution

Solution Result

ResultQuantexa has helped us narrow in on the right type of fraud — and the right type of fraud typologies—to surface networks of interest that we deem to be very high risk. With the network analytics and entity resolution capabilities that Quantexa provides, we’re not only seeing evidence of opportunistic fraud, but also organized fraud.

Challenge

Challenge Solution

Solution Result

ResultQuantexa’s AI-powered platform enables BNY Mellon to have the data trust, transparency, and explain-ability that is fundamental to financial services organizations. Quantexa provides us with an enterprise-ready option to handle data-at-scale. This is helping us meet our goal of improving digital resiliency and efficiency to provide our customers with simpler and smarter solutions.

Challenge

Challenge Solution

Solution Result

ResultIt is vital that we have the data, systems, and tools in place to join the dots and ensure we have a full contextual picture of our customers. The use of AI in Quantexa’s Decision Intelligence Platform is a step change in understanding our customers and is key for our strategic focus on best-in-class customer experience.

Challenge

Challenge Solution

Solution Result

Result

Find out how HSBC’s Global Data CIO is using data and technology to open new roads to profitability by reimagining how banks can better serve their customers.

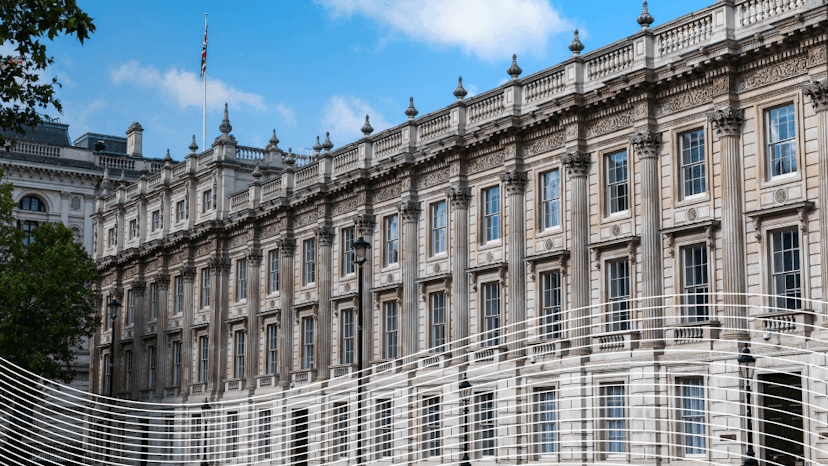

By leveraging the power of Decision Intelligence, the U.K. Government aims to recoup millions in fraudulently claimed loans granted during the pandemic — and arm lenders and other departments with insight to prevent future economic crimes.

With its implementation of Quantexa’s Decision Intelligence Platform, ABN AMRO can now generate holistic views of its corporate customers using higher-quality data – and focus its KYC resources on investigating real financial crimes.

Jennifer Calvery, Group Head of Financial Crime Risk and Compliance at HSBC tells us how her team is using new technology to help unify customer data, strengthen compliance efforts, and fight financial crime.

The inability to make the best possible use of data due to siloed information and manual processes was preventing investigators at Standard Chartered Bank from doing their best work. Innovative Decision Intelligence solutions are changing that while increasing customer service and fattening the bottom line.

DRIVE INDUSTRY TRANSFORMATION

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.