Data Management

Gain control of your data. Get a true connected view across all your data assets from internal and external sources. Improve data quality and build applications.

Request a demoIs your organization truly data-driven?

Traditional data management tools can’t resolve data inconsistencies and often require time-consuming manual remediation. Quantexa helps organizations unlock value by bringing data together from any source, revealing relationships and insights and enabling informed and confident decision-making.

HOW WE SOLVE IT

We turn data into value by adding context

Build a strong data foundation

Deliver high-quality golden records updated and enriched in real time. The result: more accurate data and trusted decision-making.

See connected relationships

Create graphs of connected data from multiple data sources. Build families, corporate hierarchies and more from any record types.

Access a single source of truth

Serve up operational data wherever it’s needed to improve operations, spark insights, and transform decisions.

Power your unique business applications

Use out-of-the-box capabilities, developer tools, and configurable building blocks to customize industry-specific solutions for your business.

THE IMPACT

What we have achieved

data resolution for rapid time to value

of data matching through Entity Resolution

in records through deduplication

We enable organizations to build a trusted data foundation

WHERE WE HELP

Build a resilient business with our data management solutions

Entity Quality Management

Score, measure, dashboard, and manage data quality at the entity level.

Contextual Master Data Management

Connect data into golden records, optimize stewardship, and correct at the source.

Dynamic Corporate Hierarchies

Automatically generate hierarchies from first-party and third-party data.

Get an overview of Quantexa’s Data Management solutions

category-leading technology

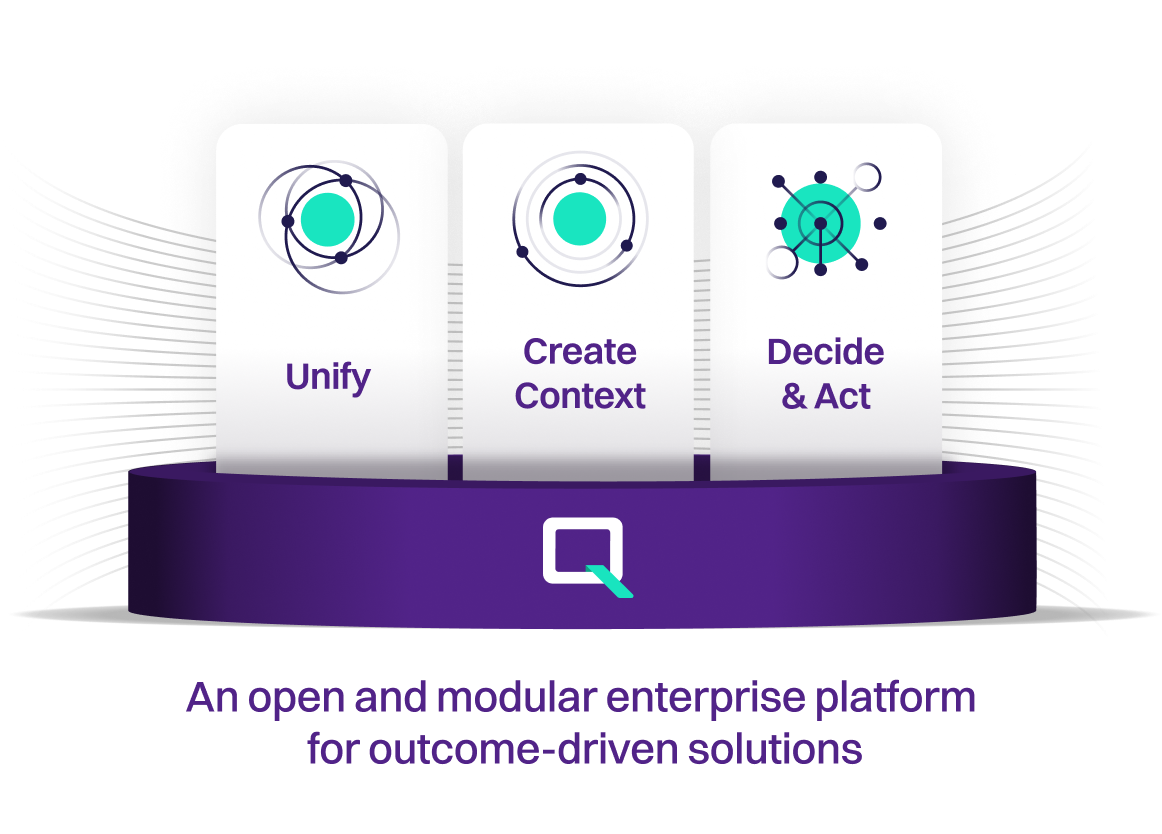

Our Decision Intelligence Platform

Build a single view of data and create a culture of confidence around critical decision-making that protects, optimizes, and grows your organization.

Decision Intelligence solutions built on our platform

Customer Intelligence

Enhance customer experience and accelerate revenue growth with a 360-degree connected view of customers.

Learn moreKnow Your Customer

Detect risk in real time to identify unknown risks and deliver more accurate risk ratings.

Risk Management

Revolutionize risk assessment with a holistic understanding of borrowers, their counterparties and relationships.

Learn moreFraud and Security

Uncover hidden fraud risks with a contextual approach to detection and prevention.

Learn moreFinancial Crime

Take a unified approach to fighting financial crime and fraud with our Contextual Monitoring solutions.

Learn moreAML and Investigations

Reduce false positive and focus on real risk by modernizing your AML monitoring, detection, and investigation.

Learn moreFAQs

Our organization’s data is poor quality at the moment. Do we need to sort this out before we engage?

Quantexa uses Entity Resolution – a data matching method that reasons like a human, using all available data and many different ways of linking records.

That is why our solution can make connections between records and enrich your data, even when quality is poor. For example, our solution demonstrated 99% data matching accuracy in an independent test. More about Quantexa’s Entity Resolution can be found here.

Our Entity Data Quality solution can help you improve data quality by identifying inconsistencies and flagging data remediation opportunities. Ensuring your organization overcomes unstructured data challenges.

MDM programs have a bad reputation/We already have an MDM solution in place. How does Contextual MDM differ from standard MDM?

Traditional MDM has often fallen at the first hurdle, taking months to years to ingest data and match it accurately at scale.

Quantexa’s schema-agnostic data ingestion capability and Entity Resolution quickly create an accurate single view no matter the variety or volume of data, generating significantly more links between data.

Traditional MDM solutions find it hard to generate business value and ROI, because a single view of the truth is too constraining.

Quantexa serves flexible data products to multiple use cases. The platform goes beyond just MDM to host vertical business applications, and is both an analytical and operational data platform.

This is why organizations such as BNYM and HSBC have selected Quantexa.

Also, Quantexa does not need to replace your MDM, it can work alongside it.

You can find out more here.

How do Quantexa’s Data Management solutions integrate with other solutions and products?

Quantexa works with your existing data integration and data governance software, integrating using streaming, API and batch approaches, building and distributing joined-up data assets such as a rich, connected customer view.

Quantexa integrates with data analytics and data science environments, including native support for data lake technologies and the Python ecosystem.

Quantexa’s cloud-native, but cloud-neutral architecture can be deployed onto all major cloud and on-premise environments, integrating with enterprise security, auditing and monitoring platforms.

Quantexa’s contextual data products and insights can be surfaced into business applications such as CRM, case management and workflow as well as digital and traditional interaction channels.

What to look for in an effective data management solution?

Organizations struggle to manage big data for decision-making, operational efficiency, customer experience and advanced analytical projects (such as AI and more).

The main things to look for in a data management solution are:

Time-to-value: how long will it take to deploy? Solutions that require your data to be transformed into a specific schema to be ingested may set your project back by months or fail before it started altogether if you run into issues. Solutions offering multi-source ingestion that is flexible and does not require data transformation on your end will accelerate time-to-value and require less resources.

Data matching accuracy: How are you going to fix data scattered across systems and data quality problems? An effective data management program will primarily focus on solving the data quality problem by joining data from siloed sources in the most accurate way, creating a trusted data foundation.

Analytics: will you have the right tools for data modelling and the AI use cases your data science team wants? By generating networks with graph analytics technology, you can uncover relationships between your data that can be used in decisioning models.

Transparency and explainability: how confident will you be in your analytics and decision-making? Make sure you are using open and transparent models that are fully accessible to end users and the data team.

Open architecture: How flexible it is to use the models and data how and where you want to.

Scalability and ROI: Is your data management future-proof and matches your organization’s ambitions? It is important to think about scalability and ROI and that’s not only about the number of data points or data sources you are able to ingest.

Flexibility: Most platforms will provide you with one view for your use case and that limits your flexibility in achieving granular user-level privacy and security settings as well as expanding to other use cases.

Learn more about Data Management solutions and how Quantexa can help.

What if we don't want to replace our existing MDM?

If your existing MDM is heavily integrated, replacing it can seem daunting. Quantexa's modular architecture means it can sit alongside your existing MDM, checking its output or feeding it with matched data.

Where can I meet other Data Management professionals using Quantexa?

Our Specialist User Groups are where customers, Quantexa experts and thought leaders can share expertise, experience and knowledge across the globe on the use of data, technology & analytics.

The Data Management User Group brings together all things to do with Data Management at Quantexa, allowing its members to open the door to a true connected view across data assets from internal and external sources, improve data quality, build applications, and take control of master data.

Latest from Quantexa

DRIVE INDUSTRY TRANSFORMATION

Speak to an expert

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.